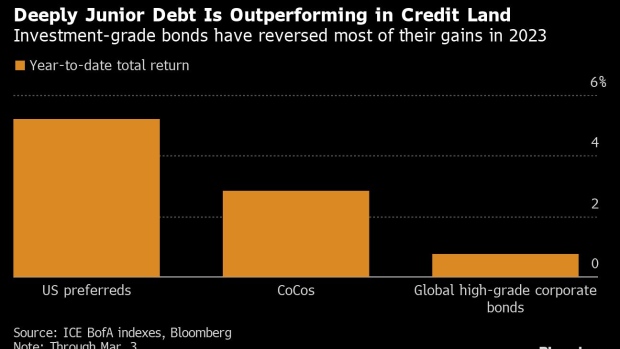

Junior debt issued by banks is risky. It only gets paid back after other bonds. But due to short duration, the losses are modest, when the interest rates rise, and they offer higher return. European banks’ junior debt, known as contingent convertibles, is up 2.8% this year, as analysts for now don't see major risks in the European banking sector.